Transaction Reconciliation

Transaction Status Updates

Clients are notified about transaction status updates in the following scenarios:

- Transactions requiring more details – Anti Money Laundering checks

- In the event of the transaction being sent to a payment partner, for last mile delivery of the payment

- Once the transaction reaches a terminal status – Returned / Paid / Rejected etc.

Note: For swift wires, the opt-in clients will receive intermediary status updates (GPI details) to provide end to end tracking of the transaction. These intermediary details provide additional visibility on the wire transactions that are in Sent to Bank status till these transactions reach a terminal status

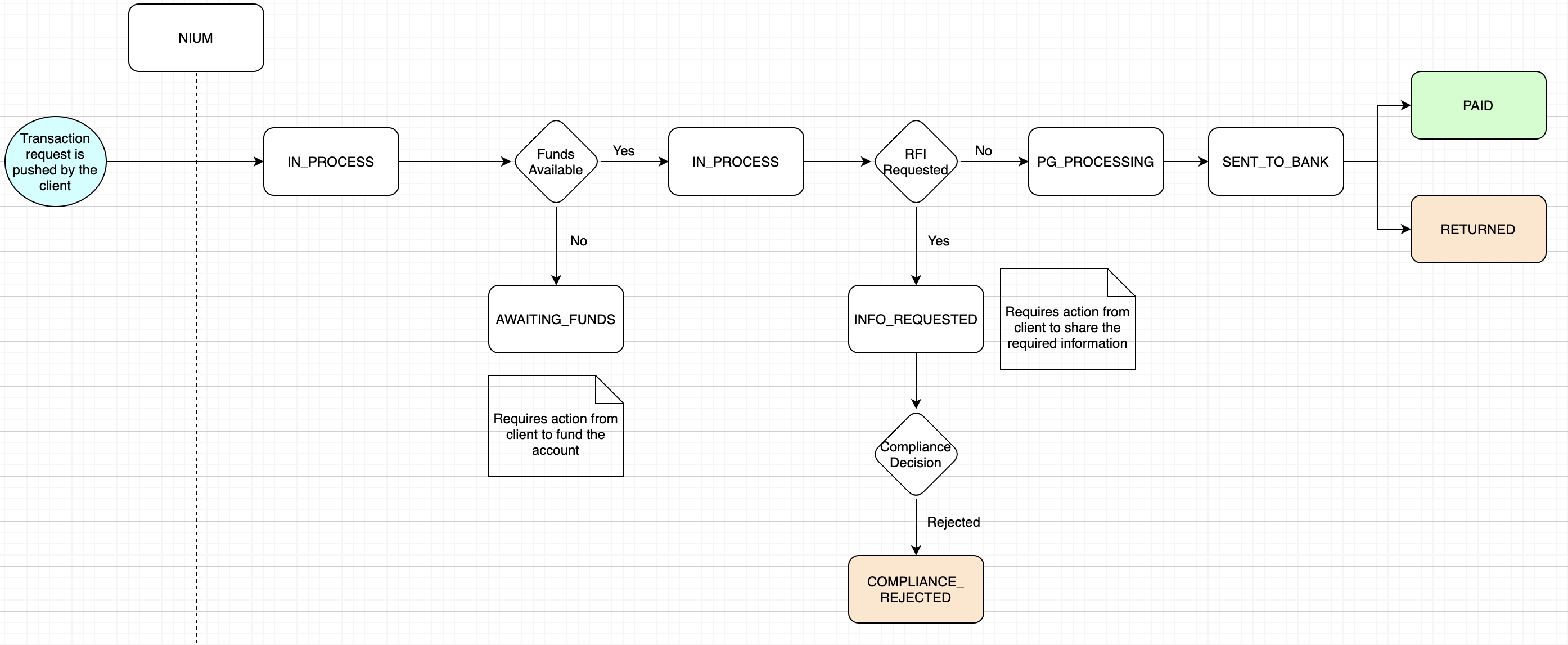

Transaction Lifecycle

A payout request submitted with NIUM might have the following statuses as part of its lifecycle:

- In Process: The transaction is being processed internally within NIUM’s platform

- Awaiting Funds: The transaction is held in the platform owing to lack of required funds for processing the transaction

- Rejected: The transaction has been rejected by the client

- Info Requested: Additional details are required by NIUM’s Compliance team for the transaction to be processed further

- Pending: The transaction is under compliance review

- Compliance Rejected: Transaction is reject ted by the compliance team owing to non-adherence to Anti-Money Laundering regulations

- PG Processing: The transaction is being processed within NIUM to get it routed via a payment partner

- Sent to Bank: The transaction has been pushed to the payment partner for the last mile delivery of the disbursement request

- Paid: The transaction has been successfully processed and the funds have reached the end Beneficiary

- Returned: The transaction is returned by the Payment Partner or by the Beneficiary

- Error: The transaction is in the error state and needs intervention from NIUM for further processing

| Transaction Status Update Notification |

|---|

| Subscribing to NIUM’s callback/web-hook services or checking the status of a Transaction via API integration: The clients may use the following set of APIs to understand the status of a transaction. |

| Get payment status via the NIUM reference ID Get payment status via the client’s reference ID Opt-in (subscribe) for GPI details for end-to-end payment tracking for Swift Wires through the callback/web services and the mentioned APIs. |

Interpretation of the gpi reason codes and associated status descriptions

| Status | gpi_reason_code | gpi_status_description | gpi_remarks |

|---|---|---|---|

| SENT_TO_BANK | G000 | Delivered to next bank | The payment has been forwarded to next participant bank in the swift network. It can be either credited to beneficiary directly or passed to next bank. |

| SENT_TO_BANK | G001 | Delivered to next bank (no tracking) | This often suggests the user may not receive gpi updates beyond this point and will receive a final terminal status. |

| SENT_TO_BANK | G002 | Pending credit may not be same day. | Often it means that the payment is under manual due diligence in the bank and settlement may take few hours. |

| SENT_TO_BANK | G003 | Pending receipt of documentation from the beneficiary. | This often suggests an action on the beneficiary or beneficiary bank. Sender may contact the beneficiary in case of delays or can ensure that beneficiary details provided were correct. |

| SENT_TO_BANK | G004 | Pending receipt of funds from the previous bank. | The forward bank has received an instruction to credit the funds the to the beneficiary, but it has not received the funds yet. Cover payment is missing but it is expected to arrive soon. |

| SENT_TO_BANK | G005 | Delivered to beneficiary bank as GPI. | This suggests that the payment will be credited soon. |

| SENT_TO_BANK | G006 | Delivered to beneficiary bank as non-GPI. | This suggests that the payment will be credited soon. |