Payout - Key Concepts

Overview

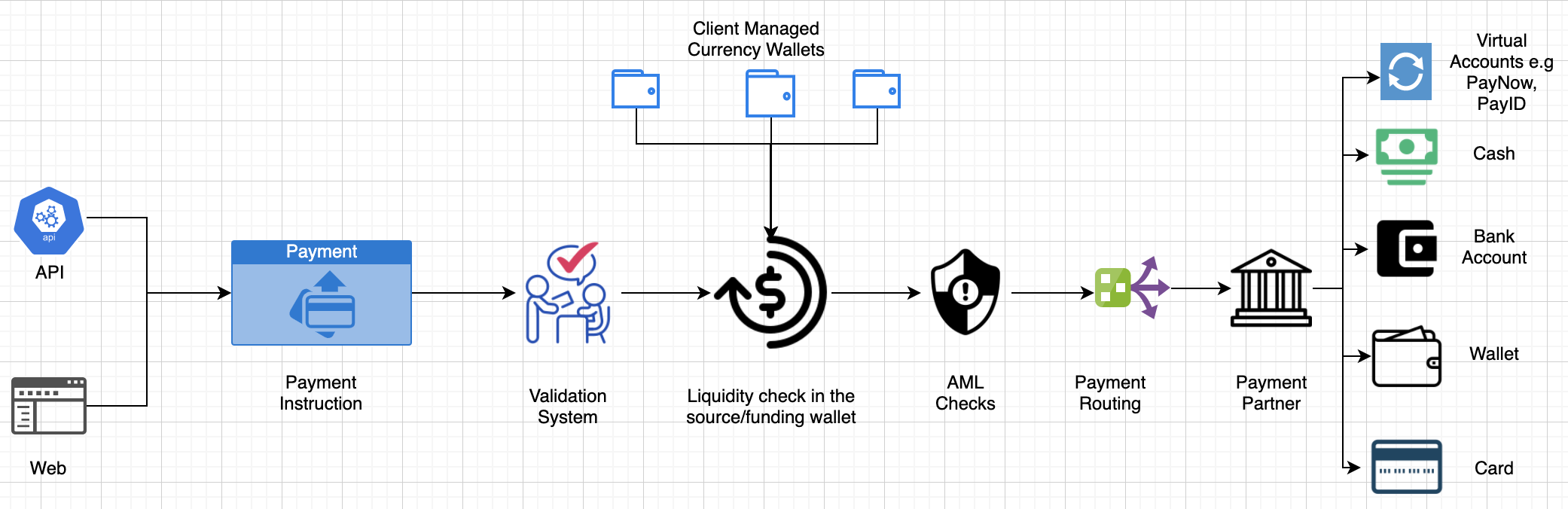

SEND capabilities enable NIUM’s clients to make disbursements to the end beneficiaries in 190+ countries. The remittances could be disbursed to Bank accounts, Card, Cash or to the e-wallet of the end Beneficiary.

Glossary of terms:

- Client - Client is an entity who has business need to move funds. As per regulation we need to do KYB for client.

- Currency Account/Wallet - Virtual account on NIUM platform that holds funds. Each Currency account has unique number and currency. A client can have multiple currency accounts.

- Remitter - Entity who intends to transfer the funds to the Beneficiary. This entity could be the client itself or the client could be doing this payout on behalf of an individual or corporate.

- Beneficiary - Entity to whom funds needs to be transferred. The Beneficiary could be an individual or a corporate.

- BookFX - Moving money from one currency account to another currency account within same client at a spot exchange rate is called as BookFX.

- RFI - Request for more information. This is required when a transaction gets flagged in NIUM’s Anti-Money laundering System and the Compliance team requires further information on the transaction before the same can be processed further.

- Masspay - Platform which facilitates the entire payout journey.

Client Onboarding

Any client who intends to use NIUM SEND platform is to be KYBed by our internal compliance team. Once the KYB process is completed, the client will be created from the backend. (Note: For Partner Relation Model, the client creation may be automated via API Integration with the Partner entity)

The configuration setup for the client is agreed as part of the PSA itself, however, the same maybe changed anytime that the client and the NIUM’s business team agree to the changes.

Funds Management

NIUM’s SEND platform can only process the payment instructions once the platform cites funds in the currency wallets. Once the client has funded the relevant wallets then the processing of the transaction shall take place. Kindly refer to the section Funds & Ledger Management section for further details around the capabilities provisioned.

Transaction Processing

The platform works as an orchestrator of various automated processes to be run onto the payment instruction basis which the eventual disbursement is made.

Basic Steps Involved:

Flow Exemplified:

Journey starts with Client signing contract with Nium to move money to beneficiary where Nium will act as intermediary.

Step 1 - Nium performs KYB for client. Current process is manual for KYB.

Step 2 - Nium creates currency account for Client.

Step 3 - Client transfers fund to Nium physical account which is shared by sales by quoting Nium’s currency account number in Narrative or reference.

Step 4 - We get an auto nudge from banking partner for the incoming money. Using Nium’s currency account number in narrative, we auto reconcile and credit the fund directly to clients currency account.

Step 5a - Client creates beneficiary in Masspay system and initiates one time money transfer to its beneficiary.

Step 5b - Client’s admin logs into Masspay platform and uploads a bulk file with beneficiary data to do a bulk movement of money to its beneficiaries.

Step 5c - Client integrates with Masspay API "Create Payment V2" to do real time money movement to beneficiary.

Step 5d - Client performs "Create BookFX By Account" or "Create BookFX By Currency" and moves money from one currency account to another currency account.

Step 6 - Client can generate account statement by calling api - "Accounts Reconciliation"

Step 7 - Client can integrate with webhook "Payment Status Update" for getting step by step information for the journey of payment happening to the beneficiary.

Step 8 - In case the status of payment goes to RFI. Using API "Get RFI details by Payment ID" client can know the reason for RFI generation and they can submit RFI data/document by calling "Submit RFI Details".