Funds & Ledger Management

NIUM platform enables the clients with the following capabilities:

- Virtual Account For Funding: NIUM platform can, on request basis, allocate virtual accounts that may be used by the clients for the purpose of funding their wallets

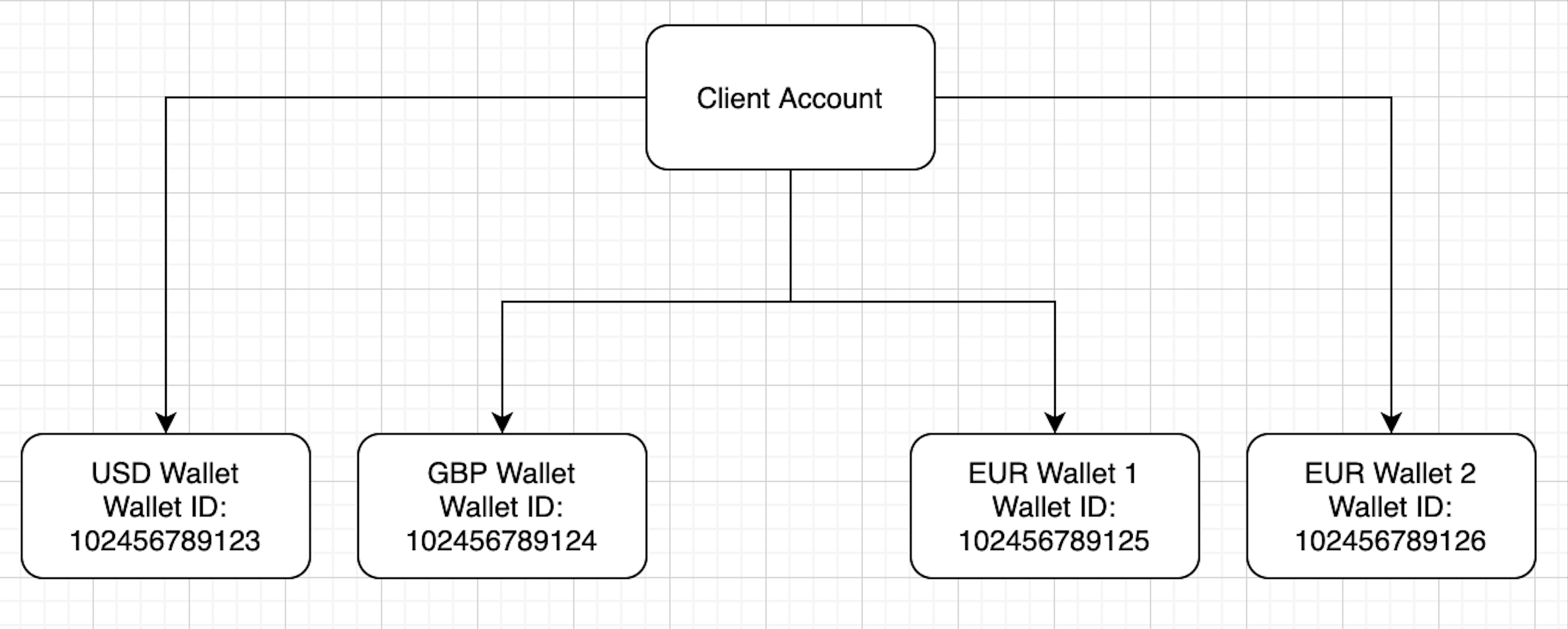

- Multiple Currency Wallets: NIUM platform enables clients to manage multiple currency wallets. The same could be funding wallets or wallets pertaining to the disbursement corridors. The clients can create multiple wallets of the same currency, as per the requirement.

- Instantaneous Application of Funds: NIUM platform enables instantaneous application of funds once the funds arrive into NIUM's physical bank account. In order to enable the same, the client needs to send the 12 digit unique currency wallet ID as part of the payment narrative.

- Funds Reconciliation: Clients can reconcile the funds across various wallets using the following capabilities:

- Funds Application notification: The clients can be notified in real-time when the funding is applied to their currency wallets. In order to be notified, the client needs to subscribe to the callback service with NIUM

- Check the existing balance across various currency wallets: The clients may check the balance of a specific wallet or all the wallets via the APIs detailed in the Balance section

- Check for the various debits or credits that were applied to the currency wallets during a given duration of time. The same may be done via the Accounts Reconciliation API

Ledger Management

NIUM platform captures every change to the wallet balances owing to the scenarios given below:

- Funding a wallet

- Moving the funds from one wallet to another with/without currency conversion. Please refer to Fx Management section to understand the various currency conversion strategies:

- Without currency conversion: The funds may be moved within the same currency denomination wallets e.g. from EUR Wallet 1 to EUR Wallet 2

- With currency conversion: The funds may be moved across different currency denomination wallets e.g from USD wallet to INR wallet

- Utilising the funds for a given disbursement: The funds may be deducted:

- Directly: Funding / source currency is same as disbursement currency e.g. funding currency is USD and disbursement is also in USD , Or

- Post a currency conversion: Funding / source currency is different from the disbursement currency e.g. funding currency is USD and disbursement is in INR. Please refer to Fx Management section to understand the various currency conversion strategies

- Deduction of funds for the purpose of settling the transaction fee in real-time

- Re-application/credit of funds to the wallet in the case of rejection/return of the disbursement request

- Adjustments done to the currency wallets by NIUM’s finance team in response to any concerns w.r.t account reconciliation

In case funds movement/payout processing requires currency conversion then the following steps are registered in ledgers:

- The funding/source wallet is debited with the amount instructed in the instruction

- The destination wallet is credited with an equivalent amount, post the currency conversion

- In case of payouts, the destination wallet is next debited for the processing of the payout.