Fx - Per Transaction Currency Conversion

The clients can opt in to convert the currency credits as and when there is a requirement for disbursement currency credits. The currency conversion happens as part of the payment instruction itself. The client may use the following 2 capabilities to achieve this

1. Market / Spot Rate:

- The conversion and payout processing happens once enough liquidity has been sighted in the funding wallet

- Existing market/spot rate (in addition to the Fx margin) is utilised to convert the funds.

- May be done via API and Web Interface

2. Locked Rate (Lock and Hold Payout)

- Use case: The client needs to get into an agreement with NIUM w.r.t the Fx rate utilised for the currency conversion

- The rate locked along with NIUM is for a given time-window and the same is agreed upon as part of the agreement / PSA

- Platform will process the payout on the pre-agreed Fx rate in case the following 2 conditions are met:

- The payment instruction arrives within the agreed time-window

- The liquidity to process the payment is cited within the agreed time-window

- Can only be done only via API integration - Payout Creation API

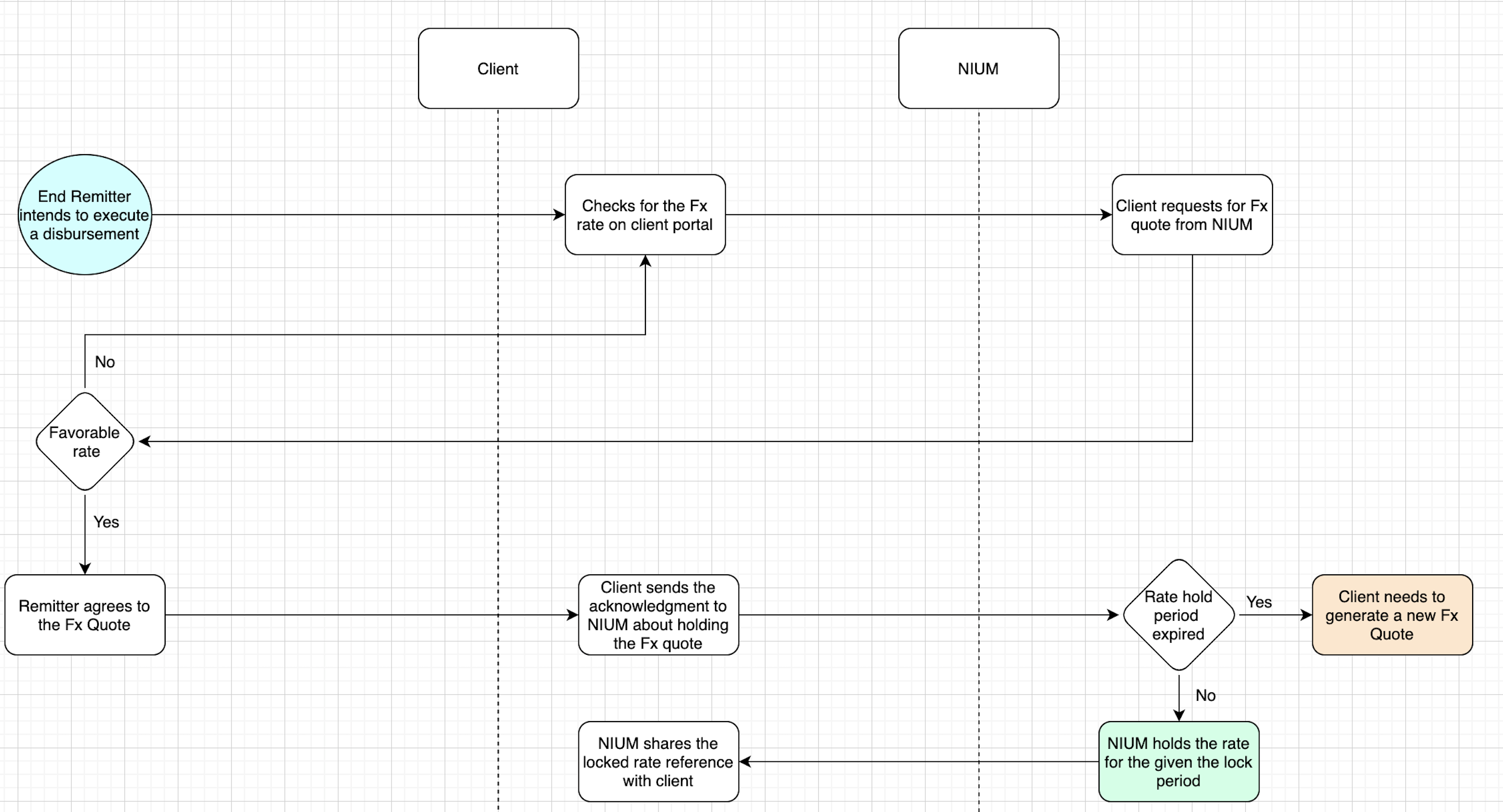

Lock and Hold Payout Flow

Rate Locking Mechanism

- The client starts with getting an Fx quote via Get Fx rate signature

- The client gets the Fx quote for the given currency pair ,and

- The time within which this rate can be locked

- Once the client is comfortable with the fx rate that is when the client locks the rate with Lock Fx rate API

- The client gets the fx_hold_id that is to be referred to in the payment API

- The time duration till when the rate shall be honoured

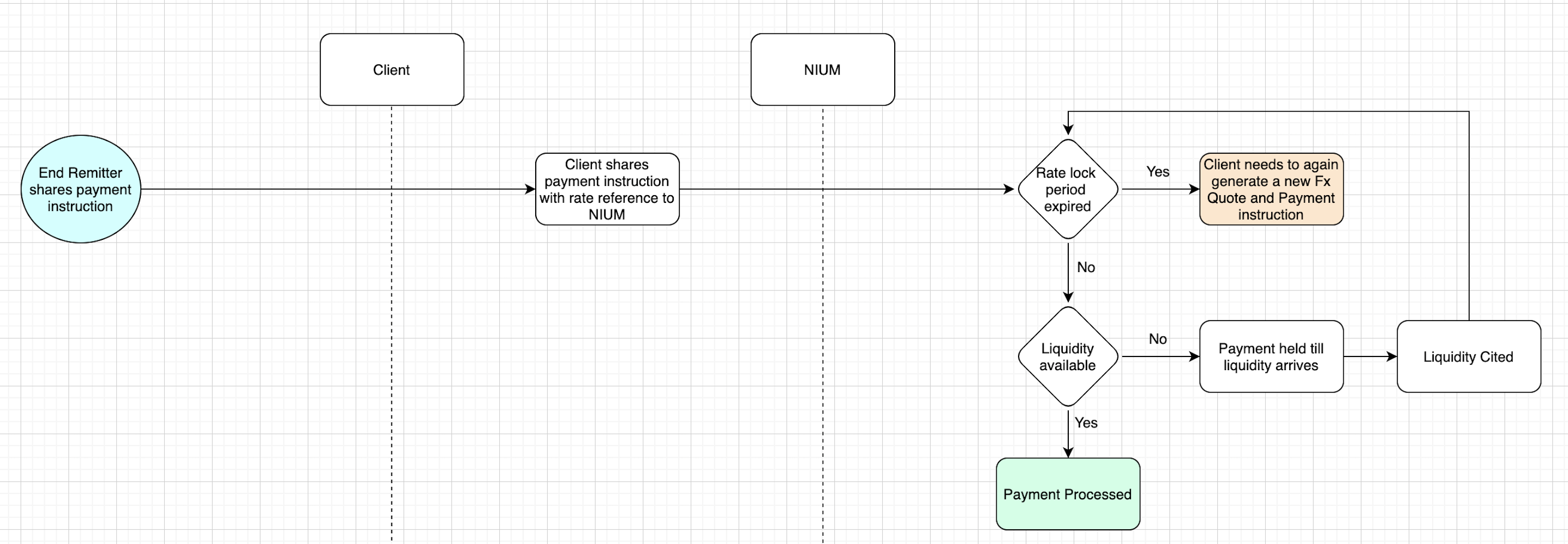

Locked Rate Utilisation

The client will use the locked rates for the given payouts by referring to the hold id in the payment request

Detailed API Interaction View

Step 1 - Clients calls the api "Get FX Rate Signature" and generate a signature by supplying currency pair for which they want to lock the rate. In response, you get spot exchange rate which will be locked for a given duration of time.

Step 2 - Call the api "Lock FX Rate" with the signature generated in step 1 , in response you will get fx_hold_id.

Step 3 - Pass this fx_hold_id to API “Create Payment v2” under payment_options => fx_hold_id.

The api will use the exchange rate which was locked in step 1.